Strategic Growth Advisory

Plan with Purpose. Scale with Confidence.

Scaling your business or nonprofit isn’t about doing more—it’s about doing what matters most, at the right time, with the right foundation.

Dr. Alberto Alexander works directly with founders, executives, and mission-driven leaders to create growth plans that are structured, strategic, and capital-ready.

🔍 What We Help You Do:

✅ 1. Clarify Your Growth Roadmap

Get clear on where you're going and how you’ll get there—with a roadmap that aligns goals, operations, and investor expectations.

Vision-to-action strategy mapping

Revenue model and pricing refinement

Expansion planning and prioritization

✅ 2. Align Your Operations for Scale

We assess internal structures to eliminate bottlenecks and prepare your business to grow without breaking systems or team capacity.

Team org chart & responsibility planning

Systems, tech stack, and automation audit

SOP and workflow documentation

✅ 3. Prepare for Growth-Stage Funding

We help you position for capital with investor-aligned planning and strategic pitch development.

Funding pathway selection

Due diligence & capital readiness review

Strategic use of funds alignment

✅ 4. Preserve Mission While Expanding

If you're a nonprofit or social-impact venture, growth should never mean losing your purpose. We ensure your expansion strategy stays aligned with your values.

Program scalability models

Mission-aligned growth KPIs

Donor/investor messaging calibration

👤 Who This Is For :

Startup founders preparing to scale

Nonprofits expanding programs or locations

Leaders navigating growth plateaus

Organizations planning funding rounds or launches

🎯 Why Work With Dr. Alberto?

Dr. Alberto Alexander is a strategic growth consultant and capital advisor with over 30 years of experience helping mission-driven organizations scale the right way.

Whether working with startups, nonprofits, or growth-stage ventures, he brings clarity, structure, and high-trust guidance to every engagement.

He’s a trusted partner for founders who want more than ideas—they want impact, systems, and sustainable scale.

📅 Ready to Scale With Strategy?

Book a free strategy call to explore how Dr. Alberto can help you build your next phase of growth with clarity and confidence.

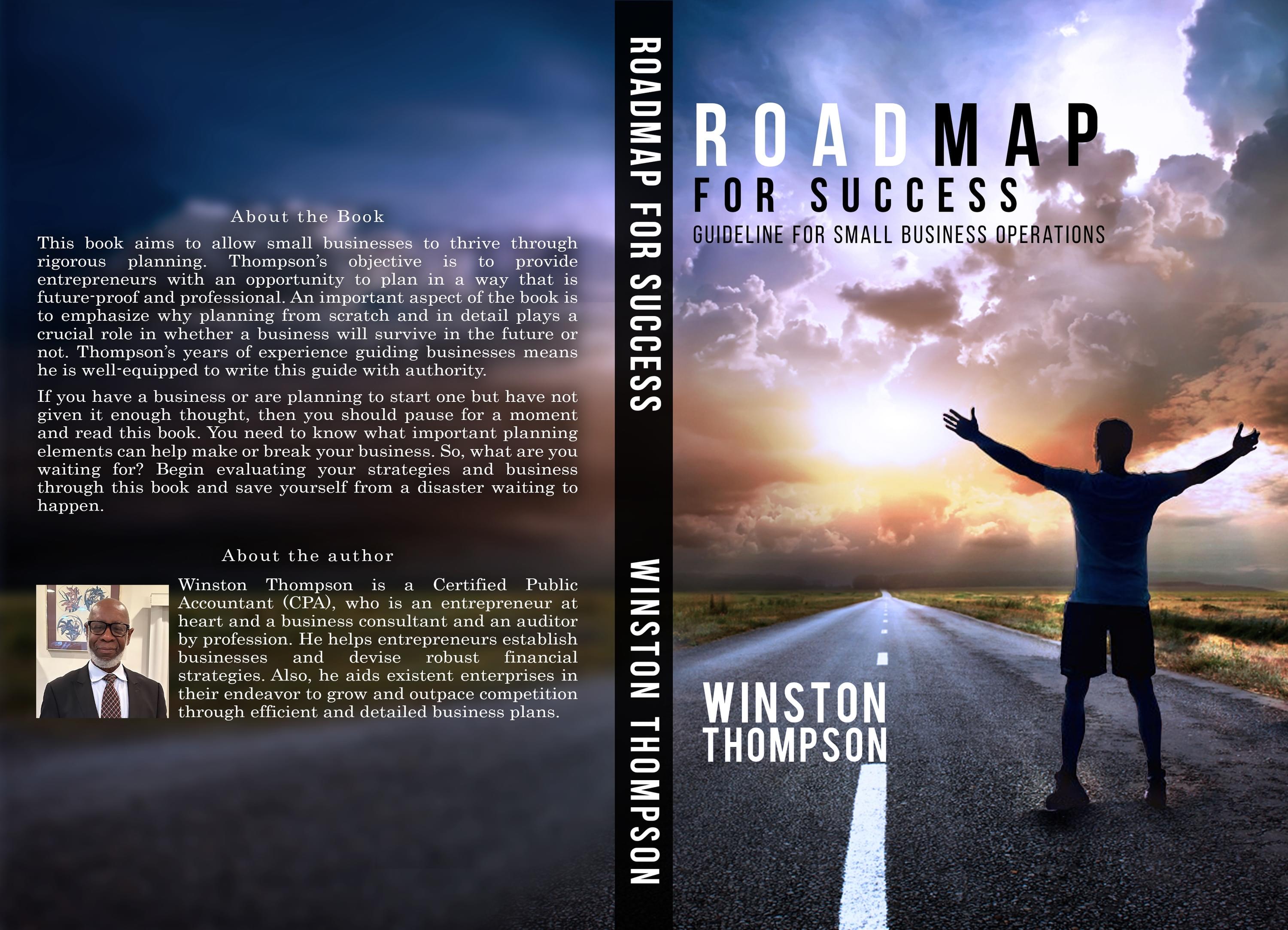

Roadmap for Success

This book aims to allow small businesses to thrive through rigorous planning. Thompson's objective is to provide entrepreneurs with an opportunity to plan in a future-proof way.

5 Tax Saving Tips

Are you tired of losing your hard-earned money to taxes every year? Are you looking for effective methods to reduce your tax burden and increase your savings?

Wealth Building Club

Join Our Wealth Building Club

and receive weekly wealth building tips, strategies and updates.

Home Seller's Guide

Home Buyer's Guide

Free Home Value

Progress Always Begins Where Your Comfort Zone Ends

Office Hours

Call us at 718-875-0556 to speak to our team.

Monday

9AM-5PM

Tuesday

9AM-5PM

Wednesday

9AM-5PM

Thursday

9AM-5PM

Friday

9AM-5PM

Testimonials

John Workman, PhD(Real Estate professional)

Thompson & Company’s ROADMAP FOR SUCCESS is a system and planning tool that small businesses can use. I highly recommend it.

Parish Shah, (Registered investment advisor)

Thompson & Company’s ROADMAP FOR SUCCESS is a system with the right tools to help small business manage their operations and grow their businesses.

Nick Perry,(US Ambassador to Jamaica)

My district is home to thousands of small businesses. I'm also aware that they struggle to keep their doors open. The challenge for them has always been a lack of a step-by-step system. Thompson & Company’s ROADMAP FOR SUCCESS satisfies this in seven steps.

Frequently Asked Questions

What is your process of working with clients?

We believe that every business, regardless of size, deserves access to quality accounting & tax services, which is why we offer a free consultation to prospective clients. During your consultation, we’ll take the time to understand your business and financial goals, identify any immediate accounting & tax needs, and provide you with a customized plan that fits your budget.

What are some of the services provided by your firm?

We offer a wide range of services, including bookkeeping and accounting, tax planning and preparation, financial statement preparation, audit and assurance services, payroll processing, and business consulting and advisory services. We also offer specialized services for particular industries, such as technology or healthcare.

What are the benefits of outsourcing accounting & tax services?

Outsourcing accounting & tax services can offer many benefits for businesses, including saving time and money. Businesses can focus on their core competencies without having to worry about complicated accounting & tax procedures. You also get access to specialized expertise, as accounting firms often employ a broad range of professionals with expertise in various financial areas.

Do I need to hire a tax professional to file my taxes?

No, you can choose to file your own taxes with the help of tax preparation software or by using the IRS Free File program. However, if you have a complex tax situation, it may be beneficial to seek the assistance of a tax professional.

How long does it take to receive a tax refund?

The timeframe for receiving a tax refund depends on how you filed your taxes and how you opted to receive your refund. If you filed electronically and opted for direct deposit, you can typically expect to receive your refund within a few weeks. If you filed a paper return or opted for a paper check, it may take longer to receive your refund.

How can accounting & tax services help my business grow?

Accounting & Tax services can help businesses grow by offering financial guidance and advice. Accounting professionals can analyze a company's financial records, identify areas for improvement, and provide recommendations for increasing profitability. They can also help businesses make informed financial decisions by forecasting financial results and evaluating potential risks.

We Love To Hear From You

Copyright © 2024